Reconcile Checks Outstanding with ISO 20022 & Real-Time RfP

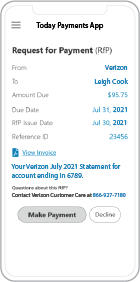

TodayPayments.com is the modern financial operations platform empowering businesses to automate Checks Outstanding Reconciliation, Aging RfP Invoicing, and real-time payment processing via ISO 20022 standards. Whether you're sending requests from a bank dashboard or directly from merchant software, we help you communicate with Payers using text, email, smartphone links, and hosted payment pages. With alias-based messaging, secure data exchange, and free downloadable templates, TodayPayments.com turns your aging receivables and check tracking into a fast, frictionless, fully digital experience.

Managing outstanding checks and overdue receivables shouldn’t require spreadsheets, guesswork, or endless follow-up calls. With the power of ISO 20022 messaging, digital Request for Payments (RfP), and modern batch upload capabilities, businesses can now automate both Aging RfP invoicing and Checks Outstanding Reconciliation—from any device. Whether it’s B2B or C2B, sent directly from Payee to Payer or initiated via a bank dashboard, TodayPayments.com equips you with ready-to-use reconciliation tools and smart invoicing templates—delivered through SMS, email, or secure mobile links.

Outstanding checks are one of the most common bottlenecks in financial reporting and AR accuracy. Using TodayPayments.com’s Checks Outstanding Reconciliation Template, you can:

- Match issued RfP requests against paid/unpaid checks

- Use aliases (email or phone) for secure payment communication

- Send real-time reminders via SMS, smartphone alert, or email

- Avoid sensitive banking disclosures with alias-based processing

Combined with ISO 20022 structured data, every transaction becomes trackable, secure, and audit-ready.

Streamlined Aging RfP Invoicing for B2B & C2B Billing

The Aging Request for Payments (RfP) process enables businesses to notify payers about invoices 15, 30, 60, or 90+ days past due. With TodayPayments.com, you can:

- Digitally send invoices via text, email, or mobile link

- Customize messages with concise 140-character payment summaries

- Embed secure hosted hyperlinks to full merchant payment pages

- Schedule one-time or recurring batch uploads using ISO 20022 formats

This solution simplifies both your communication flow and your collections process—ensuring no invoice goes unnoticed.

Batch Uploads, Smart Reporting & Free Reconciliation Templates

TodayPayments.com delivers a full suite of tools designed for AR, finance, and compliance teams:

- Batch upload capabilities using Excel, XML, or JSON for large-scale RfP invoicing

- Real-time downloadable reports for tracking responses, payment statuses, and reconciliation

- Free, customizable templates for:

- Aging Accounts Receivable (AR) Worksheets

- Checks Outstanding Reconciliation Reports

- Bank Matching for RfP Settlements

✅ "FREE" RfP Aging & Real-Time Payments Bank Reconciliation – with all merchants process with us.

To support merchants and finance teams of all sizes, TodayPayments.com offers free downloadable templates, including:

- Aging Accounts Receivable Worksheet: Pre-built with 15, 30, 60, 90+ day tracking

- Bank Reconciliation Templates: Instantly match payments with deposits across batches

- ISO 20022 File Format Samples: Plug-and-play structures for batch uploads and RfP message testing

Built for scale, speed, and smart finance automation.

If you are looking to reconcile outstanding checks using a template in software like QuickBooks or Excel, here's a general guide on how you can go about it:

1. Data Collection:

- Gather Data:

- Collect information about outstanding checks from your bank statements, accounting software (e.g., QuickBooks), or any other source.

2. Create a Reconciliation Template in Excel:

- Headers:

- Create column headers for necessary information such as Check Number, Check Date, Payee, Amount, and Status.

- Data Entry:

- Enter the details of each outstanding check into the respective columns.

3. Check Status:

- Check Status Column:

- Include a "Status" column to indicate whether the check is outstanding, void, or cleared.

- Status Update:

- Update the status of each check as you reconcile them with the bank statement.

4. Reconciliation Process:

- Bank Statement Comparison:

- Compare the information in your reconciliation template with the corresponding entries in your bank statement.

- Mark Cleared Checks:

- As you identify cleared checks in the bank statement, mark them as cleared in your template.

- Voided Checks:

- Identify any voided checks and mark them accordingly.

5. Analysis and Adjustment:

- Discrepancies:

- Investigate and resolve any discrepancies between the reconciliation template and the bank statement.

- Adjustments:

- Make any necessary adjustments to your accounting records or the reconciliation template to ensure accuracy.

6. Record-Keeping:

- Documentation:

- Keep a record of the reconciliation process, including any adjustments made.

- Reconciliation Reports:

- Generate reconciliation reports if available in your accounting software.

7. Using QuickBooks for Reconciliation:

- QuickBooks Reconciliation:

- In QuickBooks, navigate to the "Banking" menu and select "Reconcile."

- Enter the bank statement details and compare with your QuickBooks records.

- Mark outstanding checks as cleared in the reconciliation window.

8. Final Steps:

- Save and Update:

- Save your reconciliation template and update it regularly as new checks are issued or cleared.

- Regular Reconciliation:

- Perform check reconciliation regularly to keep your financial records accurate.

9. Automation (if available):

- Automation in QuickBooks:

- Explore automation features in QuickBooks that can streamline the reconciliation process.

- Import/Export:

- If using Excel, consider importing/exporting data between Excel and your accounting software.

Remember to customize the template and reconciliation process based on your specific needs and the features available in your accounting software. Always refer to the latest documentation for the software you are using for any specific functionalities or updates related to reconciliation.

Stop chasing down old checks and overdue invoices. With TodayPayments.com, you can reconcile outstanding checks, automate RfP invoicing, and track everything—digitally, instantly, and securely. Use ISO 20022 messaging, aliases, and mobile invoicing to stay in control.

👉 Get your free

reconciliation and aging AR templates now.

🚀

Visit

https://www.TodayPayments.com and upgrade how you

invoice, reconcile, and report—today.

ACH and both FedNow Instant and Real-Time Payments Request for Payment

ISO 20022 XML Message Versions.

The versions that

NACHA and

The Clearing House Real-Time Payments system for the Response to the Request are pain.013 and pain.014

respectively. Predictability, that the U.S. Federal Reserve, via the

FedNow ® Instant Payments, will also use Request for Payment. The ACH, RTP® and FedNow ® versions are "Credit

Push Payments" instead of "Debit Pull.".

Activation Dynamic Checks Outstanding, RfP Aging and Bank Reconciliation worksheets - only $49 annually

1. Worksheet Automatically Aging for Checks Outstanding, Requests for Payments and Explanations

- Worksheet to determine "Reasons and Rejects Coding" readying for re-sent Payers.

- Use our solution yourself. Stop paying accountant's over $50 an hour. So EASY to USE.

- No "Color Cells to Match Transactions" (You're currently doing this. You won't coloring with our solution).

- One-Sheet for Aging Request for Payments

(Merge, Match and Clear over 100,000 transactions in less than 5 minutes!)

- Batch deposits displaying Bank Statements are not used anymore. Real-time Payments are displayed "by transaction".

- Make sure your Bank displaying "Daily FedNow and Real-time Payments" reporting for "Funds Sent and Received". (These banks have Great Reporting.)

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.